2025 Standard Deduction Over 65 Vs Itemized

Blog2025 Standard Deduction Over 65 Vs Itemized - What Is The 2025 Federal Standard Deduction For Seniors Nomi Tallou, Evaluate which option offers more tax benefits based on your individual tax. Apple Watch New Release 2025 Price. Restrictions and other terms (opens in new. A new […]

What Is The 2025 Federal Standard Deduction For Seniors Nomi Tallou, Evaluate which option offers more tax benefits based on your individual tax.

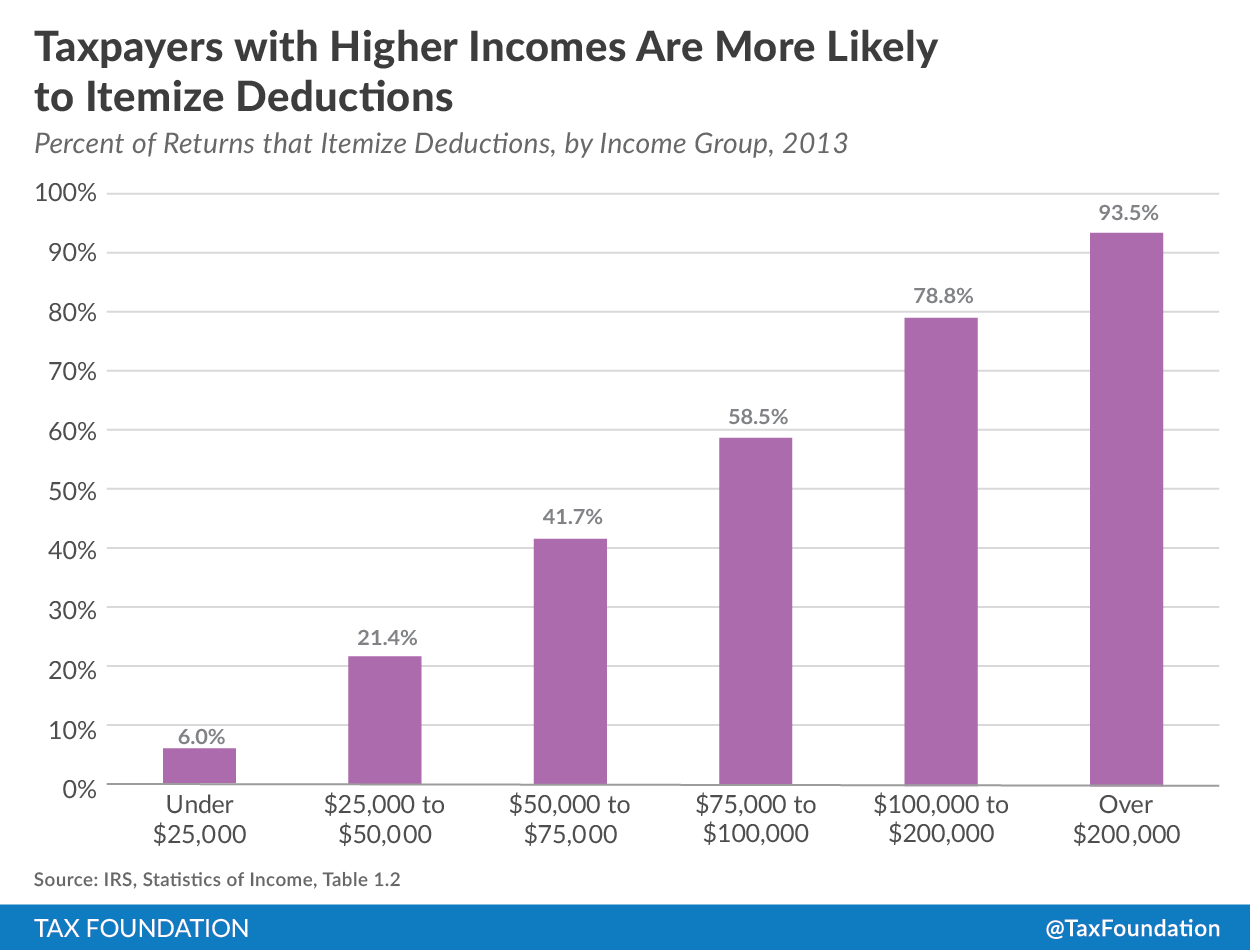

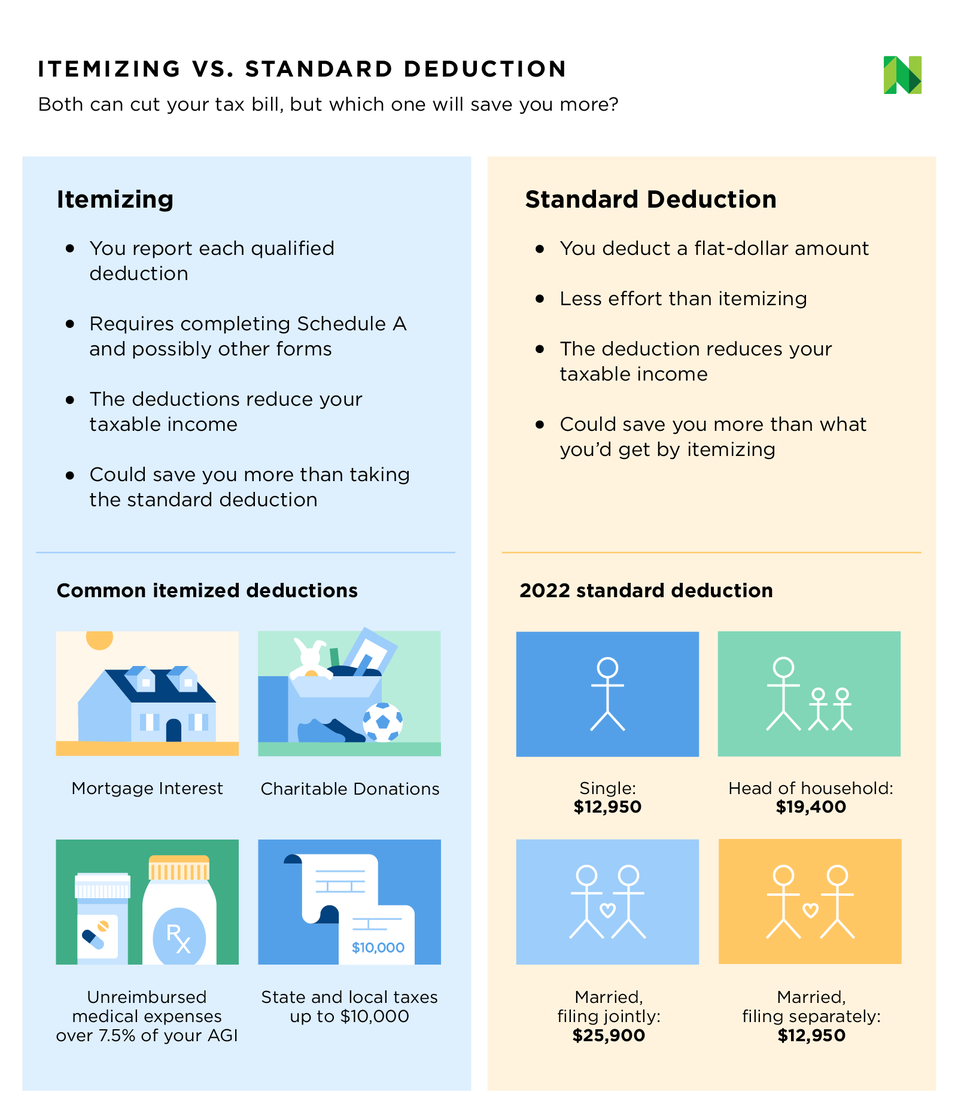

Standard Deduction For 2025 Tax Year Over 65 Katee Ethelda, — choosing to itemize or take the standard deduction depends on whether your itemized deductions exceed the standard deduction amount.

Irs Standard Deduction 2025 Over 65 Single Gerri Juanita, — for ty 2025 (returns due in april 2025), the standard deduction amounts are:

Walmart Open On Labor Day 2025 In India. On monday, september 2—as well as the […]

2025 Standard Deduction Over 65 Tax Brackets Alysa Bertina, — the irs on thursday announced higher federal income tax brackets and standard deductions for 2025.

List Of Itemized Deductions 2025 Tax Tasha Fredelia, Check the standard deduction amount for your filing status.

Standard Deduction For 2025 Tax Year Over 65 Jada Myrilla, — the irs on thursday announced higher federal income tax brackets and standard deductions for 2025.

Standard Deduction For Individuals Age 65 Or Older And Single A, You don’t pay federal income tax on every dollar of your income.

2025 Tax Brackets For Married Seniors Elaine Othella, — here’s what that means:

Evaluate which option offers more tax benefits based on your individual tax. When it comes to reducing your taxable income, you have the option of taking either the standard deduction or itemized.

2025 Standard Deduction Over 65 Vs Itemized. — standard deductions for taxpayers over 65. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase of $750.